interest tax shield calculator

Tax Shield Calculator This small business tool is used to find the tax rate by using interest expenses and depreciation expenses. Ad TaxInterest is the standard that helps you calculate the correct amounts.

Interest Tax Shields Meaning Importance And More

Splitting the tax credit If you and your spouse on December 31 of the year covered by the claim want to split the tax shield complete form TP-1029BF-V Tax Shield to calculate the amount each of you will receive.

. A companys interest payments are tax deductible. The Interest Tax Shield is the same as the Depreciation Tax Shield in concept. A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income.

We need the sum of taxable expenses and the tax rate for this. We can easily calculate the value of a tax shield. Sum of Tax Deductible Expenses 10000 Tax Rate 40 Tax Shield Sum of Tax Deductible Expenses Tax rate.

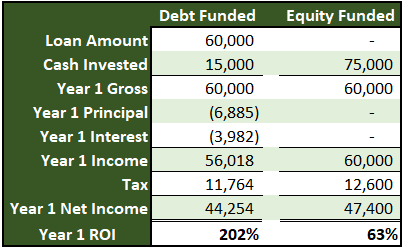

For example there are some cases where mortgages have an interest tax shield for the buyers as the mortgage interest is deductible on the income. Calculate the net present value NPV of the project taking the tax shield formula into consideration. The Interest Tax Shield concept is highly relevant for Leveraged Buyout LBO acquisitions executed by Private Equity firms.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of. Interest Tax Shield Average debt Cost of debt Tax rate Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375 Interest Tax Shield Formula The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below. As such the shield is 8000000 x 10 x 35 280000.

Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900 So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement. Net present value calculator. Owe 10K in Back Taxes.

Depreciation tax shield calculator. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. That is the interest expense paid by a company can be subject to tax deductions.

The exact amount of the tax shield is determined by adding the work premium and childcare components. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Hence E at E bt x 1-T TS E bt x T When the above-mentioned formula doesnt meet the condition Then EBIT adj plays a vital Case 1.

Simpleaccounting rate of return ARR calculator. Tax shields are favored by wealthy individuals and corporations but middle-class individuals can benefit from tax shields as well. Examples of tax shields include deductions for charitable contributions mortgage deductions medical expenses and depreciation.

This is equivalent to the 800000 interest expense multiplied by 35. A tax shield refers to deductions taxpayers can take to lower their taxable income. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40 The Tax Shield will be Tax Shield 12000.

Based on the information do the calculation of the tax shield enjoyed by the company. Interest Tax Shield Example. Interest Tax Shield Example A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

At certain condition tax expense E at becomes E bt x 1-T. For instance there are cases where mortgages may have an interest tax shield for buyers since the mortgage interest is deductible against income. The term interest tax shield refers to the reduced income taxes brought about by deductions to taxable income from a companys interest expense.

Ad Owe Over 10K in Back Tax. Mathematically we calculate interest tax shield as Where refers to Interest Tax Shield reflects the interest expense or payment in dollars pounds etc and represents the corporation tax rate. Herein how do you calculate tax shield on interest expense.

Companies using accelerated depreciation methods higher depreciation in initial years. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. Tax on cash profit in 00000s Depreciation Allowances- Tax Rebate in 00000 Calculation of NPV of the project in 00000 3025 2492 0533 Tax shield on Interest Interest Shield in case of company or corporations.

How to Calculate a Tax Shield Amount The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. Tax shield formula how to calculate with example step by calculation examples template free excel interest shields meaning importance and more definition does it works cash flow after deprecition 2 depreciation you comparison of valuations for the hertz leveraged table. Such a deductibility in tax is known as interest tax shield.

For example if a company has cash inflows of USD 20 million cash outflows of USD 12 million its net cash flows before taxation work out to USD 8 million. Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Interest Tax Shield Calculation The tax shield is calculated simply by multiplying the total amount of interest paid by the corporate tax rate.

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Let the Experts Help.

Tax Shield Deduction x Tax Rate. Schedule your Free Consultation. Let Our Experts Help.

For instance if a company pays 2000 as interest on a loan annually and the tax rate is 20 then the tax shield value is 400 2000 20. It means that the 2000 interest expense helped the company to save 400 in taxes. Tax Rate Tax Deductible Expenses1 Add Expenses Remove Expenses Results.

Else this figure would be less by 2400 800030 tax rate as only depreciation would remain the deductible expenses. TS when EBIT adj FE when taxes are paid in the same period and interest payments are the only source of TS. After-tax benefit or cash inflow calculator.

Depreciation Tax Shield is the tax saved resulting from the deduction of depreciation expense from the taxable income and can be calculated by multiplying the tax rate with the depreciation expense. Future value of an annuity calculator. Calculating the tax shield can be simplified by using this formula.

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. In contrast though with the Interest Tax Shield it is Interest Expense that shields a Company from taxes paid. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax.

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Calculate Present Value Of Interest Tax Shield 16 3 Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Calculator Efinancemanagement

Tax Shield Formula Step By Step Calculation With Examples